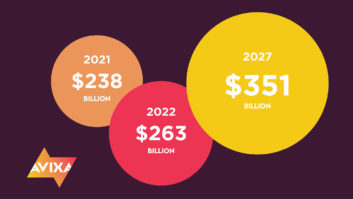

New York, NY (June 26, 2019)—The global professional audiovisual industry will grow to more than $325 billion in 2024, from $247 billion in 2019, according to updated forecasts in the new 2019 AV Industry Outlook and Trends Analysis (IOTA) Global Summary produced by AVIXA. Overall, the demand for pro AV products and services is driven by rising GDP across much of the globe because the pro-AV industry provides solutions to nearly all facets of the economy.

“Those who have followed AVIXA’s previous forecasts will note the new estimates represent an upward revision,” said Sean Wargo, senior director of market intelligence, AVIXA. “The hike in the revised forecasts reflects strong economies and demand for new products and services. The growth in pro AV revenue is actually outpacing expectations for global GDP growth.”

For the first time, the new IOTA report includes additional data from distributors and integrators to track the amount of markup over the manufacturer price that is applied by the pro AV channel. In 2019, markups are projected to represent an additional $22 billion in revenues globally, before accounting for services revenue.

“The story of pro AV is ultimately one of the value-add offered by the distributor and providers in the creation of exceptional experiences from the raw materials of AV products,” said Wargo. “This story isn’t complete without accounting for this value through the markups applied by the channel, as they source and optimize hardware and services together. AVIXA now more accurately accounts for this in its channel revenue estimates.”

Until the latest report, the Americas had consistently represented the largest pro AV revenue-producing region. The new forecast shows the Asia-Pacific region overtaking the Americas in 2019.The Americas represent $89 billion in revenue for 2019, compared with $90.6 billion for APAC. The gap swells to more than $15 billion by 2024. APAC’s growth is spurred in part by the region’s demand for security, surveillance, and life safety solutions, which in turn fuels growth in the streaming media, storage, and distribution (SMSD) product segment. SMSD is forecast to expand at a compound annual growth rate (CAGR) of 10.5 percent in the Asia-Pacific region from 2019 through 2024.

The Pro AV market in the Americas is projected to continue its growth, although at a slower pace than APAC. With a CAGR of 4.7 percent, the Americas will reach $112 billion in revenue in 2024. The corporate segment will be a major driver of pro AV market growth for the region, with revenue rising at a CAGR of 4.2 percent from 2019 through 2024. The shift to private, public, and hybrid cloud deployments over purely on-premises solutions is driving much of the growth. The research also shows growth in markets for environmental systems and performance and entertainment solutions.

Meanwhile, Europe, the Middle East, and Africa (EMEA) will experience moderate growth of 4.5 percent CAGR through 2024, despite near-term economic challenges. The region will capture the largest percentage of revenue for audio equipment among the three regions and is expected to overtake the Americas in this segment with $6.7 billion in 2024. Revenue from video displays, particularly direct-view LED, will see considerable growth in EMEA. This product segment is forecasted to grow at 8.4 percent in the region over the next five years. The region’s highest pro AV revenue source is the corporate market. Although the revenue from the corporate market in EMEA is smaller than the amount captured by other regions, this $18 billion market is a crucial part of EMEA pro AV.

The IOTA report was produced by AVIXA in conjunction with IHS Markit, an insights and intelligence firm. The research methodology includes manufacturer inputs, both in the form of qualitative and quantitative guidance on the size and growth within various product categories. Interviews and further data collection among distributors, integrators, and end users helps determine the segmentation of products into solutions and markets. The research methodology also helps verify the flow of product, any commensurate markups applied by suppliers, and value-added services sold. The combined methodological approach makes IOTA the most comprehensive and representative report on the total pro AV channel on the market today, according to AVIXA.

IOTA report • www.avixa.org/IOTA

This story originally appeared at svconline.com as https://www.svconline.com/industry/global-pro-av-industry-will-reach-325-billion-in-2024-according-to-2019-avixa-iota-report